Your Advantage.

Expert mortgage and insurance advice driven by customer service and conservation goals

Whether you’re buying your first home, a home mover, on a mission to save money, looking for a large loan or a buy-to-let landlord, we’ve got you covered. We utilise the latest technology to make your journey as hassle free and convenient as possible.

We believe there’s always a solution! No matter how complex, we want to hear from you. Why not book an appointment now with one of our friendly advisers?

Monthly Amount Calculator

Stamp Duty Calculator

Our average ‘Application to Offer’ time frame last month was:

19 working days

Available today

Transparency

Not all mortgages are available through brokers. That’s why we’ll always let you know about any cheaper deals that we’re aware of when we make our recommendation. Nothing hidden here.

Giving

We strive to make the world a better place in any little way we can. By participating in ‘micro-giving’ with the charity Buy1Give1, we support causes such as conservation and clean water projects.

Technology

All Advantage customers have their own Secure Client Portal for information, messages and documents. However we always tailor our solutions to you, whether face to face, via telephone or email.

Specialism

Whilst we arrange finance for people in all situations, we have areas we think we excel in. Contractors, self-employed, first time buyers, older borrowers, or those with credit issues, we are here to help.

NO MORTGAGE NO FEE

Unlike many brokers, we put our money where our mouth is. Our advice is always 100% free; this means if you decide to proceed with a mortgage application, if it doesn’t result in an official offer, you won’t pay a penny to us.

News & Views

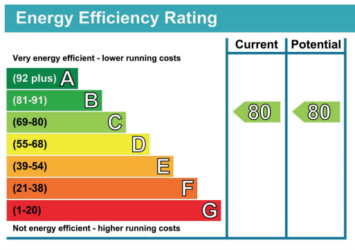

What’s a Green Mortgage?

If you’re a prospective homeowner, or just looking to move. You may have noticed the term ‘Green Mortgage’ is becoming more popular. In the current housing environment where house prices, energy bills and interest rates are rocketing. It’s becoming more important to consider the EPC rating of the property you are buying.

Bank of England to remove Mortgage Affordability Rules – What does this mean?

Following the announcement that the BOE are raising the base rate to 1.25%, there has also been a somewhat surprise announcement that the UK central bank will end the affordability test from Aug....