I’ve been having more conversations recently with clients about which type of product to go for. With fixed rates so high right now, it’s worth considering the alternatives, but it’s important to understand how these products work and what risks you’re taking.

One common question I’ve been asked recently is what the difference between a “Tracker” and a “Discounted Variable” is.

Tracker mortgages are directly linked to a certain index, most commonly the Bank of England (BoE) base rate. If the base rate goes up, your rate will go up too by the same amount. Likewise, if the BoE decrease the base rate, a tracker will go down by the same amount too.

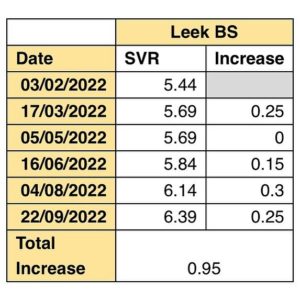

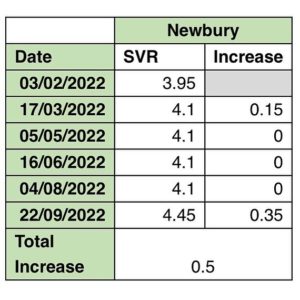

Discounted variable rates, on the other hand, are not directly linked to the base rate, but they are linked to the lender’s standard variable rate (SVR). These SVR’s are set by the bank or building society, and although they typically change as a reaction to any BoE base rate changes, they do not necessarily follow the same exact patterns.

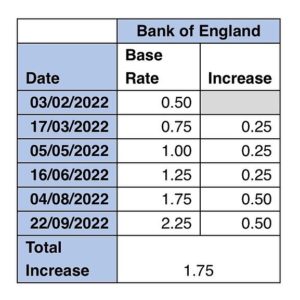

Since Feb 2022, the Bank of England have increased the base rate from 0.50% to 2.25% – an increase of 1.75%. I’ve compared this with 3 Building Societies currently offering Discounted Variables, and they, in comparison, have only increased their SVR’s by 0.5%, 0.95% and 1.15%. This means they have not passed on the full costs of the base rate increases to their members. This is only a small sample, but it seems a common pattern with Building Societies that are, of course, keen to look after their members, being mutual organisations.

With all of this being said, a discounted variable may or may not be right for you. As always, it is vital to speak to a broker, even more so than ever right now! Do not listen to “Dave down the pub” or any Meerkats you may come across… What is right for one person may not be right for another, so seeking some bespoke advice from a mortgage expert is the only sensible way forward.

Your home may be repossessed if you do not keep up repayments on your mortgage.