EPC Certificates – Mortgage Lenders offering better products for “green” properties

Within the mortgage market, there is a growing spotlight on the environmental impact of properties. With climate change being a serious global concern, some mortgage lenders are trying to help fight the potential crisis by encouraging homeowners to make their properties more energy efficient.

According to recent figures from Nationwide, energy efficiency ratings are currently having a limited impact on house prices, despite the ‘push to go green’.

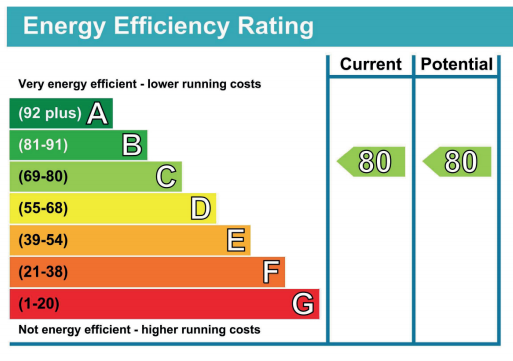

This analysis suggests that a more energy efficient property rated A or B attracts a modest premium of 1.7% compared to a similar property rated D (the most commonly occurring rating).

There was reported to be little difference for properties rated C or E compared with D. However, there was suggested to be a more noticeable discount for properties rated F or G, the lowest energy efficient ratings, which are typically valued 3.5% lower than a similar D rated property.

It’s not only first-time buyers and existing homeowners who are facing decisions over EPC’s and energy efficiency. Current legislation in England and Wales requires buy-to-let properties to have at least an EPC rating of E or above.

In order to improve the energy efficiency of rental properties, the government wants to increase the requirement to C for all new tenancies by 2025, and for all existing tenancies by 2028.

However, according to a recent poll of around 750 landlords by The Mortgage Works (TMW), more than a third (35%) of respondents said they were not confident they will be able to bring their properties up to the required EPC standard.

This is not only due to a lack of available capital, but also a lack of awareness regarding what it takes to achieve a C rating. The biggest issue raised was perceived property constraints, which more than half (51%) of landlords thinking this will be a hurdle, although 10% did not anticipate facing any challenges.

In terms of cost implications, 61% of landlords said they will need to spend money to get their properties up to an EPC C standard. More than one in 10 (14%) outlined that they will need to spend all of their annual rental income, and perhaps even more than that, on making the improvements to their properties.

In sharp contrast, nearly a third (29%) said they will need to spend less than 30% of their annual rental income.

The role of property valuations and surveys in improving energy efficiency in homes remains crucial and this is where more conversations between surveyors, lending partners and intermediaries will help formulate better solutions to create a more aligned environmentally-friendly approach across the mortgage market.

If you own a BTL property, and have any questions or concerns regarding the changes to criteria surrounding EPC certificates, please contact us for more information.