If you’re a prospective homeowner, or just looking to move. You may have noticed the term ‘Green Mortgage’ is becoming more popular. In the current housing environment where house prices, energy bills and interest rates are rocketing. It’s becoming more important to consider the EPC rating of the property you are buying.

It goes without saying that a property with a higher EPC rating will be cheaper to run than an equivalent-sized property that’s lower down the scale. This is where the Green Mortgage comes in.

Not only is buying an ‘eco home’ going to save you on bills, but your mortgage is likely to be cheaper as well. A green mortgage is simply a mortgage that is available to homes with an EPC rating of at least a C grade. Most properties built since 2012 will fall into this category but plenty of upgraded older homes will now be scoring well on the EPC chart.

How do I check what the EPC is for the property I’m looking at?

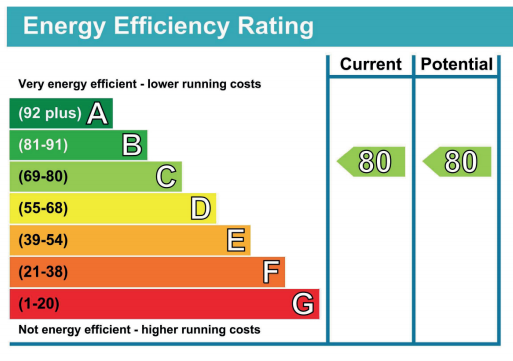

If you’re looking at an online advert for a property. Most of the time the EPC certificate is on the advert itself. If not, then this link https://www.gov.uk/find-energy-certificate will take you to the national database so you can check there. The certificate gives a current rating and a potential rating.

At the moment the majority of Green Mortgages reward you for buying an eco-property. One lender, Kensington, give you £1000 if you improve your EPC rating and it goes into the next bracket. This can be given at any point during your mortgage term.

The savings range from a lower fee on application to a lower interest rate of up to .3% on the mortgage. Food for thought when you’re setting those rightmove filters!