Josh found us through Facebook and had been quoted rates over 5% for his first mortgage due to past credit issues. We halved the rate and here’s how.

In my spare time, I answer people’s questions on Facebook about mortgages. It’s a pretty sad busman’s holiday of a hobby, but every now and again it produces a real win. Josh messaged me directly after I’d responded to his question on a Facebook group. Not only did it turn out that he lived less than a mile from me, but we have friends in common! The stakes were pretty high to get a result for him.

The Challenge

Josh, like me, runs his own business. We both work in industries which have luckily boomed during COVID. As a result he was finally in a position to secure the family home he’d always planned for. The only issue was that two obstacles stood in his way, his credit history and the estate agent…

The estate agent in question was one of the big national estate agencies with their own mortgage service. They were demanding he used their broker, despite this ‘request’ contravening the estate agents’ code of conduct.

Out of principle, Josh was against this. To make matters worse they had taken a month to try and find him a mortgage. When they did, it was with a specialist adverse lender VIDA homeloans, with a rate an interest rate over 5%…

The Solution

After exchanging messages Josh and I had time to talk about where he was up to with the estate agents broker. What challenges he was facing and how they were currently trying to solve them. Josh had a default which was just over 3 years old and his income for the most recent year was much higher than previous. The other broker was lining up lenders that use the most recent year’s income, in order to get the mortgage amount Josh needed. This meant the choice of lenders was slim. Combining that AND Josh’s defaults left him with few lenders, who only offered the eye watering rates I mentioned above.

Looking at the Bigger Picture

As I often do, we spent 10 minutes or so discussing his goals. Why was Josh looking to buy now, what was he looking to get out of the house he was going for? Josh told me that he and his partner Olivia had been living with family in order to save for the deposit. They were desperate to capitalise on a property during the stamp duty deadline. They had saved so hard for a sizeable deposit. The first thing that struck me, was this was not a solo project. Josh’s partner Olivia was currently on maternity leave and was also desperate to get into their own home.

It turned out that Josh assumed Olivia’s income could not be used for the mortgage because she was on maternity leave. He had only requested the mortgage to be just in his name with the estate agent broker.

Eureka!

It is not only possible but really quite easy to use income for someone on maternity leave. After discussion, Josh advised he would actually prefer a joint mortgage, but didn’t realise this was possible. Using Liv’s maternity income changed the game. Even with an average of Josh’s last 2 years self employed income, lenders could offer them enough money. This opened up over triple the number of lenders and, lo and behold some high street ones that could potentially accept Josh’s past defaults.

I hung up the phone for 5 minutes, ran some numbers and within half an hour we had found a mortgage for Josh at a rate of 2.7% – less than half he’d quoted elsewhere

The Moral of the Story

Never be pressured into using a service. See more about your consumer rights in choosing a mortgage broker in our News and Views article.

A good mortgage broker is more than a personal shopper, who just seeks out what you have asked them for. They will challenge your preconceptions, but only to come up with better alternatives. Assuming this is done politely and with good intent when you first speak with a broker, this is perhaps the best indicator that they know their onions. We are very happy to say, it has saved Josh and Olivia over £5,000 in interest alone over the next 3 years. We wish you many years of happiness in your new home!

Sound Familiar? Get in touch!

If your past credit is making a mortgage difficult, just click the ‘Book a consultation’ button below and see what we can do differently.

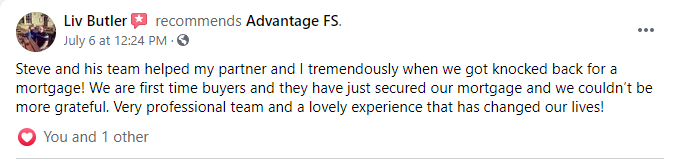

The Client’s Verdict